If you go back in history see how Pakistan was created as a country. One can find out Pakistan’s weird obsession with religious fundamentalism, and extremism—one hungry Parsi man who later converted to Islam was bait for the creation of Pakistan as a country.

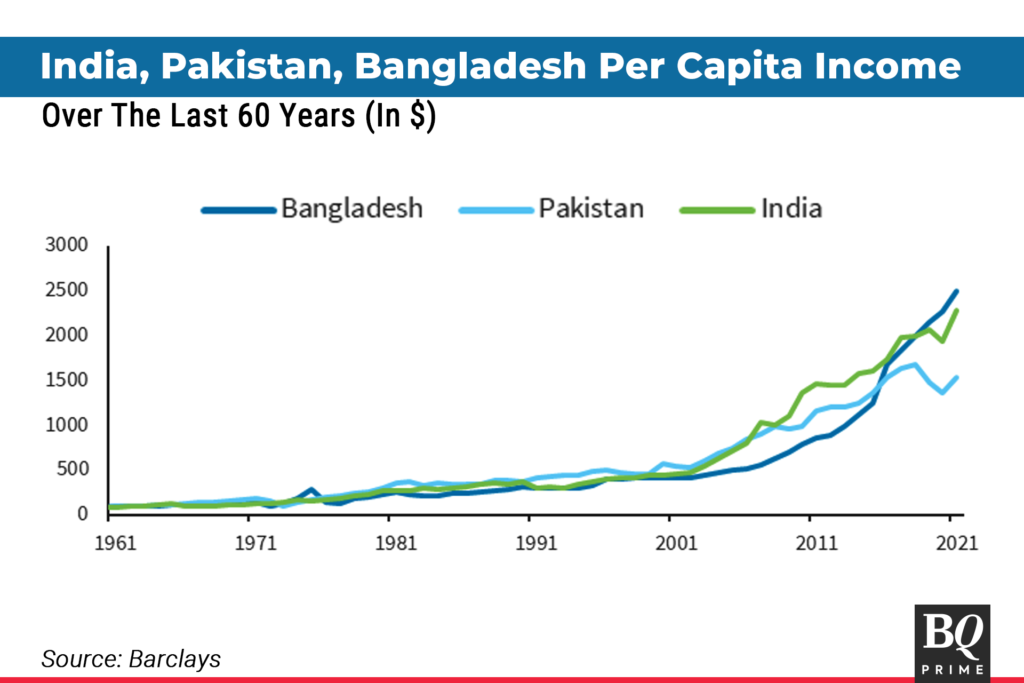

Pakistan was richer than India till 1980s

If you go back in history, experts called Pakistan the Japan of South Asia. The country was growing at an extremely fast pace socioeconomic was increasing at a rapid speed.

If you look at the Pakistan light blue line in the above chart it was at its peak in the 80s. Started falling as India started rapidly after LPG reform in 1991. The decline behind Pakistan’s growth is not only because India started growing but also due to Pakistan’s internal Pakistan policy . By the time of 1980 Pakistan had fought 2 wars against India in which Pakistan lost both due to which internal turmoil started in the establishment.

One of the reasons why Pakistan had to knock on the door of the IMF is due to the war against India. Pakistan was stubborn in Kashmir’s issues running proxy from out of the border which eventually backfired Pakistan as it lost all the money and resources without achieving anything on the ground, for a country whose GPD is a mere $400 billion with a massive population of 245 million spends nearly 15% of GDP in military.

Pakistan shares a strange relationship with the IMF. Our story begins in the early 1980s. The first time Pakistan turned to the IMF for assistance was in 1988. Facing economic instability, high debt, and a struggling economy, Pakistan sought help from the IMF to stabilize its financial situation.” Over the years, Pakistan has approached the IMF multiple times. Various challenges, including balance of payments issues, fiscal deficits, and economic reforms drove each request for aid.”

“In the 1990s, Pakistan again sought IMF support. Structural Adjustment Programs (SAPs) were introduced, focusing on economic reforms and austerity measures. These programs were designed to help Pakistan overcome economic difficulties but often led to significant social and economic adjustvments.”The 2000s saw Pakistan turning to the IMF once more. The country faced new challenges, including political instability and global economic pressures. The IMF provided several bailout packages during this period to help Pakistan stabilize its economy.””More recently, Pakistan has continued to seek IMF assistance. In 2013, the IMF approved a substantial bailout package under the Extended Fund Facility (EFF) to support Pakistan’s economic reforms and growth strategies.””In 2018, another bailout package was granted, reflecting ongoing challenges in managing economic stability and implementing required reforms.

The relationship between Pakistan and the IMF underscores the ongoing need for financial support and economic management.””Since its first request in 1988, Pakistan has turned to the IMF numerous times. Each instance represents a critical moment in Pakistan’s economic history, highlighting the ongoing struggle to achieve financial stability and sustainable growth.” over the decade, the country has sought financial assistance from IMF 23 times, reflecting its ongoing economic challenges and reliance on external support

Historical Context

Pakistan first engaged with the IMF shortly after its independence in 1947. However, it was not until the 1980s that the country began to rely more heavily on IMF assistance due to increasing fiscal deficits and external debt pressures. The 1980s marked a turning point, as Pakistan entered into multiple agreements, leading to structural adjustment programs aimed at stabilizing its economy.

The 2000s and Beyond

In the 2000s, Pakistan faced severe economic challenges, including rising inflation, energy shortages, and terrorism-related instability. The 2001 agreement with the IMF led to a focus on economic reforms and privatization, while subsequent programs in 2008 and 2013 sought to address similar issues. The 2019 agreement was particularly significant, as it aimed to address a balance of payments crisis exacerbated by the COVID-19 pandemic.

The 2019 Extended Fund Facility (EFF)

The EFF agreement in 2019 marked Pakistan’s 22nd loan program with the IMF. The deal aimed to provide Pakistan with $6 billion over three years to stabilize its economy. Key conditions of the agreement included:

- Fiscal Consolidation: A commitment to reduce the fiscal deficit from 7.1% of GDP in 2018 to 4.9% by 2021.

- Monetary Policy Adjustment: Tightening of monetary policy to curb inflation, targeting an inflation rate of around 5% by the end of the program.

- Structural Reforms: Reforms in the energy sector, tax collection, and public sector enterprises to improve efficiency and reduce losses.

Economic Performance Post-Agreement

The performance of Pakistan’s economy post-2019 agreement has been mixed. While some structural reforms were initiated, challenges such as political instability, global economic pressures, and natural disasters continued to impede progress.

- Inflation Rates: Inflation surged, peaking at 14.6% in January 2020, largely driven by food prices.

- GDP Growth: GDP growth plummeted to -0.4% in FY2020, the first contraction in over a decade.

2022 and Beyond

In 2022, Pakistan faced renewed economic challenges, including devastating floods that caused extensive damage to agriculture and infrastructure. The IMF stepped in with additional support, emphasizing the need for further reforms and fiscal discipline.

Key Future Challenges

- Debt Sustainability: Pakistan’s public debt has reached alarming levels, raising concerns about its ability to meet repayment obligations.

- Political Stability: Political instability and governance issues can hinder the implementation of necessary reforms, impacting future negotiations with the IMF.

Pakistan’s IMF Lending History

| Year | Loan Amount (USD) | Purpose |

|---|---|---|

| 1958 | $25,000 | Initial bailout |

| 2008 | $7.6 billion | Major financial support |

| 2023 | $3 billion | Prevent default |

Concusion

Pakistan’s relationship with the IMF has been characterized by cycles of borrowing, reform, and economic turbulence. While the IMF has played a crucial role in stabilizing the economy during crises, the associated conditions often pose significant challenges for sustainable growth. The future of this relationship will depend on Pakistan’s ability to implement effective reforms, maintain political stability, and manage its economic challenges.

As the country navigates these complex dynamics, ongoing engagement with the IMF will likely remain a key component of Pakistan’s economic strategy. Understanding this relationship is essential for grasping the broader implications for Pakistan’s economy and its citizens.